Computational Methods for Promoting and Predicting Project Campaigns in Crowdfunding Environments

Forecasting

Forecasting

| August 15, 2016 – July 31, 2018

Forecasting

EAGER: An Integrated Predictive Modeling Framework for Crowdfunding Environments

Crowdfunding has emerged as the “next big thing” in entrepreneurial financing. It can provide seed capital for start-up companies, create job opportunities and revive lost business ventures. The concept of crowdfunding is analogous to crowdsourcing or micro-financing, where the seed capital is collected by soliciting small amounts of money from a large group of people, rather than from just one or a few venture capitalists. Over the past few years, crowdfunding platforms have helped their users raise several billion dollars worldwide, thereby becoming a viable mechanism for people seeking funding to jump-start their business ventures.

In spite of the widespread popularity and innovativeness in the concept of crowdfunding, however, many projects are still unable to succeed. This is especially problematic under the “all or nothing” crowdfunding model where the creators do not receive any amount if the project does not receive the intended goal amount by the end of the project goal date. Although the domain of crowdfunding appears to be intuitive and simple at the outset, it poses several new challenges from the analytics perspective due to the heterogeneous, complex and dynamic nature of the data associated with crowdfunding campaigns.

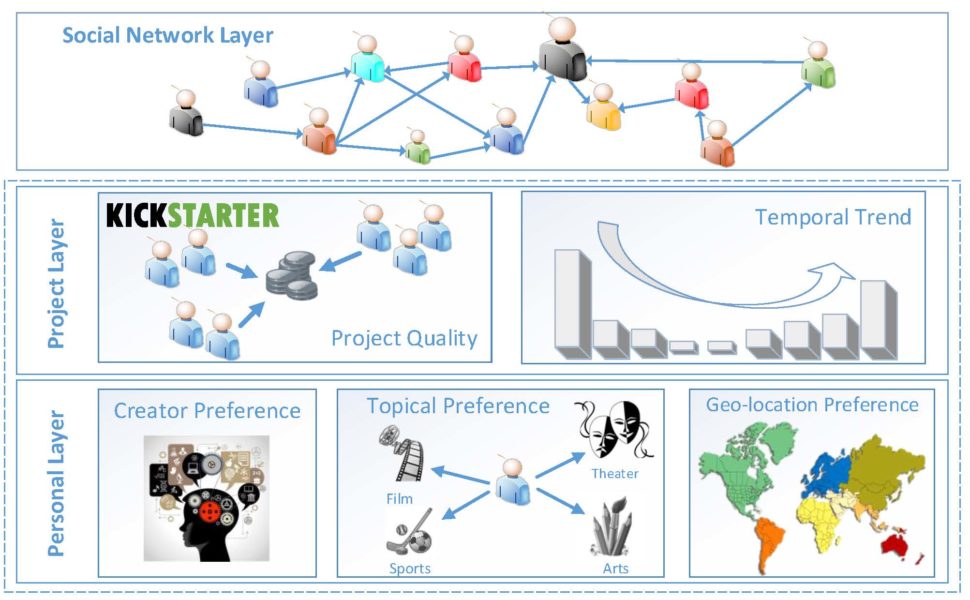

This project analyzes the behavior of users on crowdfunding platforms to better understand and predict the decision making of crowdfunding users on investing projects. In addition, we study the problem of project success, which is multi-factorial and depends on a wide range of elements which are hard to characterize. A deeper understanding of the factors affecting investment decisions will not only give better success rate to future projects but will also provide better guidelines for project creators interested in funding the projects. To achieve this, we develop new machine learning models and analytical tools to solve some of the complex underlying problems in recommending investors and projects, while effectively bringing funding success to crowdfunding based projects.

We investigate new research problems targeted to (1) recommending crowdfunding projects to individuals and groups of investors and (2) predicting the success (and time to succeed) of the crowdfunding projects. The design and development of the recommendation frameworks for supporting crowdfunding campaigns and the underlying techniques provide theoretical and technical advances to the crowdfunding research community. Modeling of various heterogenous, dynamic and complex factors that influence the decisions on project investment represents a major research challenge. We adopt a data-centric, systematic approach to tackle the problem by developing a supervised machine learning model and a new probabilistic model to capture investment decisions under crowdfunding scenarios. With these models, we address research issues that arise due to various unique features to estimate various model parameters. In addition, we develop integrated classification and regression models that can effectively predict the time taken for project success in the presence of different types of training data.

This project is funded by the National Science Foundation. The progress of the project and the research findings are available at the project website